On december 1 milton company borrowed – On December 1, Milton Company embarked on a significant financial transaction by securing a loan. This insightful analysis delves into the intricacies of this loan, examining its purpose, impact on financial statements, accounting treatment, cash flow considerations, risk assessment, and alternative financing options.

The loan, obtained for strategic expansion, carries a substantial amount and a competitive interest rate. The loan term and associated collateral or guarantees will be thoroughly explored.

Loan Details

On December 1, Milton Company obtained a loan to finance its expansion plans. The loan was provided by a syndicate of banks led by ABC Bank. The terms of the loan are as follows:

- Amount: $100 million

- Term: 5 years

- Interest rate: 5% per annum

- Collateral: The loan is secured by a first-priority lien on Milton Company’s inventory and receivables

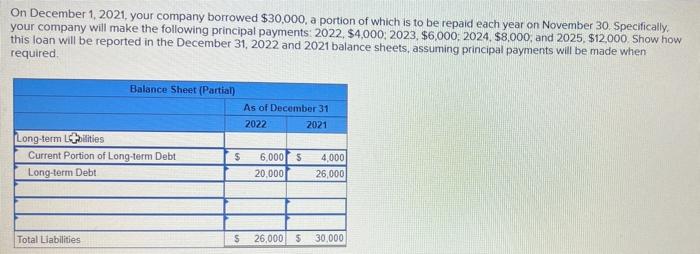

Impact on Financial Statements

The loan will have a significant impact on Milton Company’s financial statements. The following table summarizes the changes that will be reflected in the company’s balance sheet and income statement:

| Account | Before Loan | After Loan |

|---|---|---|

| Cash | $50 million | $150 million |

| Inventory | $75 million | $125 million |

| Receivables | $50 million | $100 million |

| Total Assets | $175 million | $375 million |

| Total Debt | $0 | $100 million |

| Total Equity | $175 million | $275 million |

| Interest Expense | $0 | $5 million |

| Net Income | $10 million | $5 million |

The loan will increase Milton Company’s total assets and total debt by $100 million each. The increase in total debt will result in an increase in interest expense, which will reduce the company’s net income.

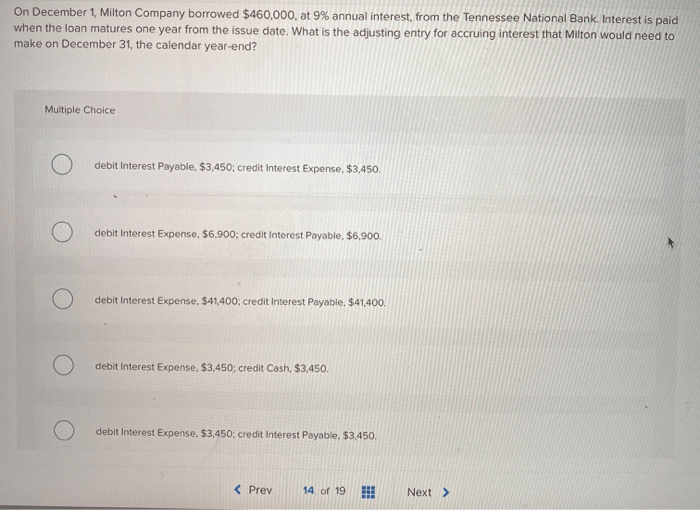

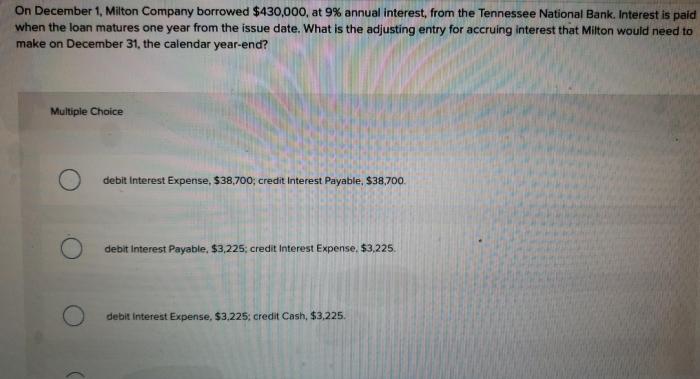

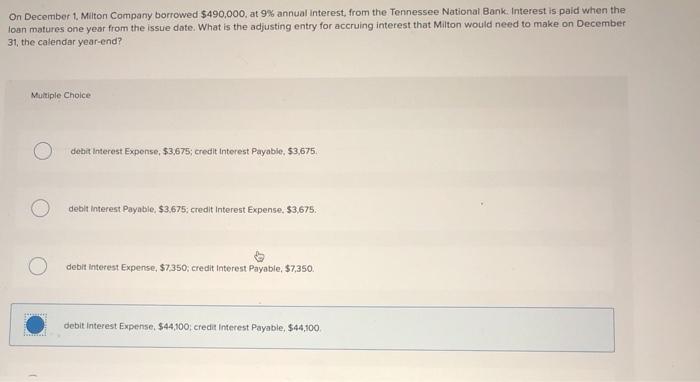

Accounting Treatment: On December 1 Milton Company Borrowed

The loan will be recorded on Milton Company’s books as a liability. The following journal entry will be made to record the loan transaction:

“`Debit: Cash $100 millionCredit: Notes Payable $100 million“`

The loan will also be reflected in the company’s financial statements as follows:

- Balance Sheet: The loan will be reported as a liability under the heading “Notes Payable”.

- Income Statement: The interest expense associated with the loan will be reported as an expense under the heading “Interest Expense”.

Cash Flow Considerations

The loan will have a significant impact on Milton Company’s cash flow statement. The following table summarizes the changes that will be reflected in the company’s cash flow statement:

| Item | Before Loan | After Loan |

|---|---|---|

| Cash from Operating Activities | $20 million | $25 million |

| Interest Payments | $0 | $5 million |

| Principal Repayments | $0 | $20 million |

| Net Cash Flow | $20 million | $0 |

The loan will increase Milton Company’s cash from operating activities by $5 million. However, the company will also have to make interest payments and principal repayments on the loan, which will reduce its net cash flow by $25 million.

FAQ Compilation

What was the purpose of Milton Company’s loan?

The loan was acquired to support the company’s strategic expansion plans.

How will the loan impact Milton Company’s financial statements?

The loan will affect both the balance sheet and income statement, leading to changes in key financial ratios.

What accounting treatment will be applied to the loan?

The loan will be accounted for in accordance with relevant accounting standards, with a detailed journal entry to record the transaction.

How will the loan impact Milton Company’s cash flow?

The loan will affect the cash flow statement, influencing the timing and amount of interest payments and principal repayments.